13. How is DBOE Options different from Futures, Spot and Options?

The cryptocurrency market has been witnessing 3 strong growth waves:

The first wave was the spot market.

The second wave is the futures market.

The third wave - also the current growth wave with great growth potential: the options market.

So what is the difference between spot, futures, and options trading - especially DBOE options trading in the crypto market?

A spot transaction is when a contract between a buyer and a seller is executed immediately at the time of the transaction at a specified price and quantity.

A futures contract is one of four types of derivatives contracts (including futures, options, forwards, and swaps) that agree to buy or sell cryptocurrencies at a certain price at a particular time in the future. The parties are required to execute the transaction according to the signed contract no matter how much the price of the crypto currency changes on the expiration date.

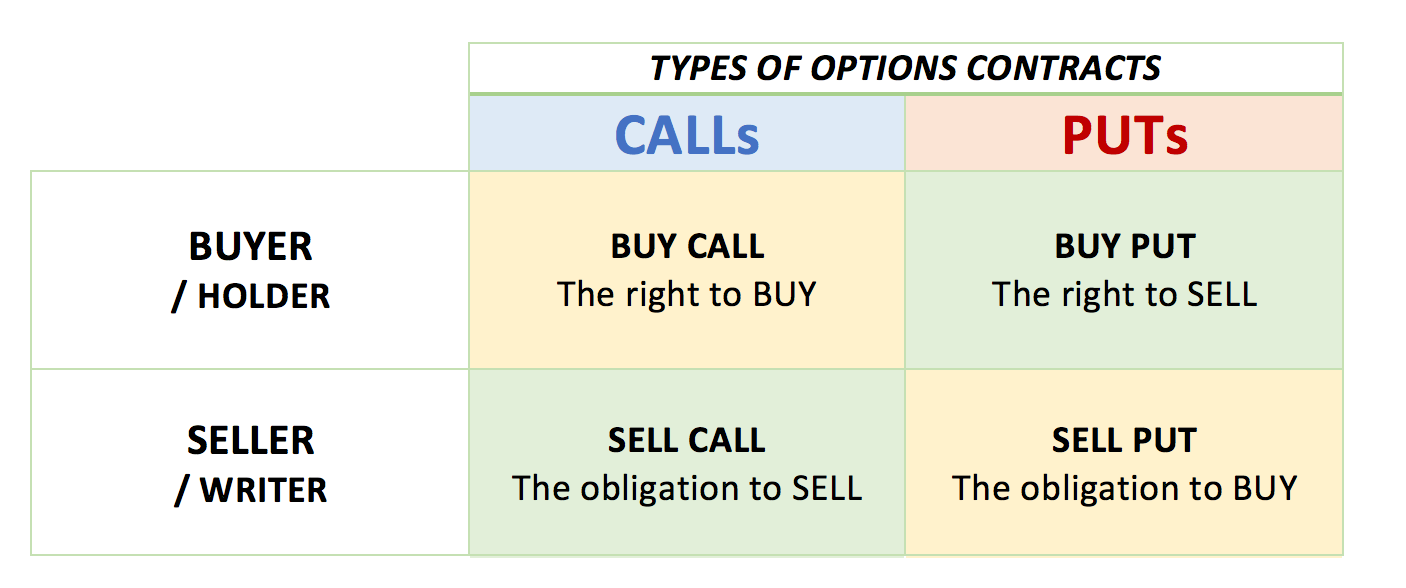

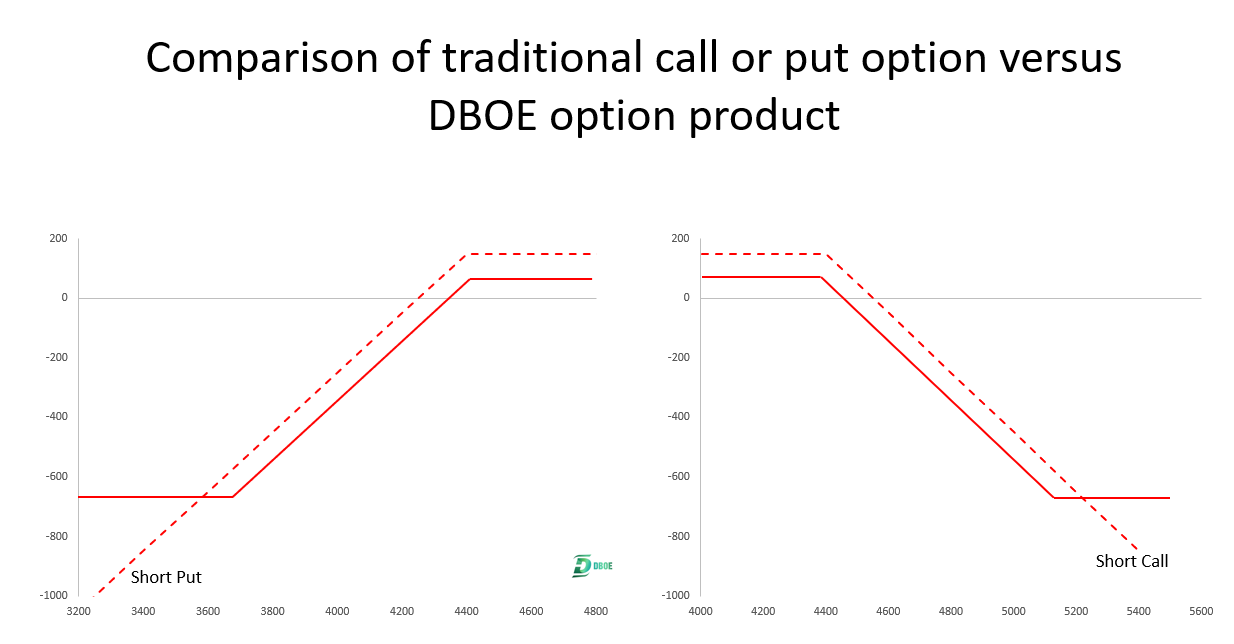

An options contract gives the buyer the right to exercise the contract on the expiration date or not (while the seller is still obligated to perform the contract). Because traditional options in the market still have the ability to cause sellers to suffer infinite losses, leading to "burning out" of their accounts, many exchanges currently only allow users to buy options, not sell them. But this problem is still not completely optimal for investment funds.

The DBOE options contract is a European-style options contract, in which to manage risk, investors will choose "price volatility ranges". As a result, there will be no big loss when in the seller position. DBOE provides full rights (Long Call, Long Put, Short Call, Short Put), helping both individual investors and investment funds to maximize profits and minimize risk.

Last updated