Step-by-Step Guide to Start Trading on DBOE

To start trading on DBOE, you simply need a Metamask wallet. The process involves four easy steps:

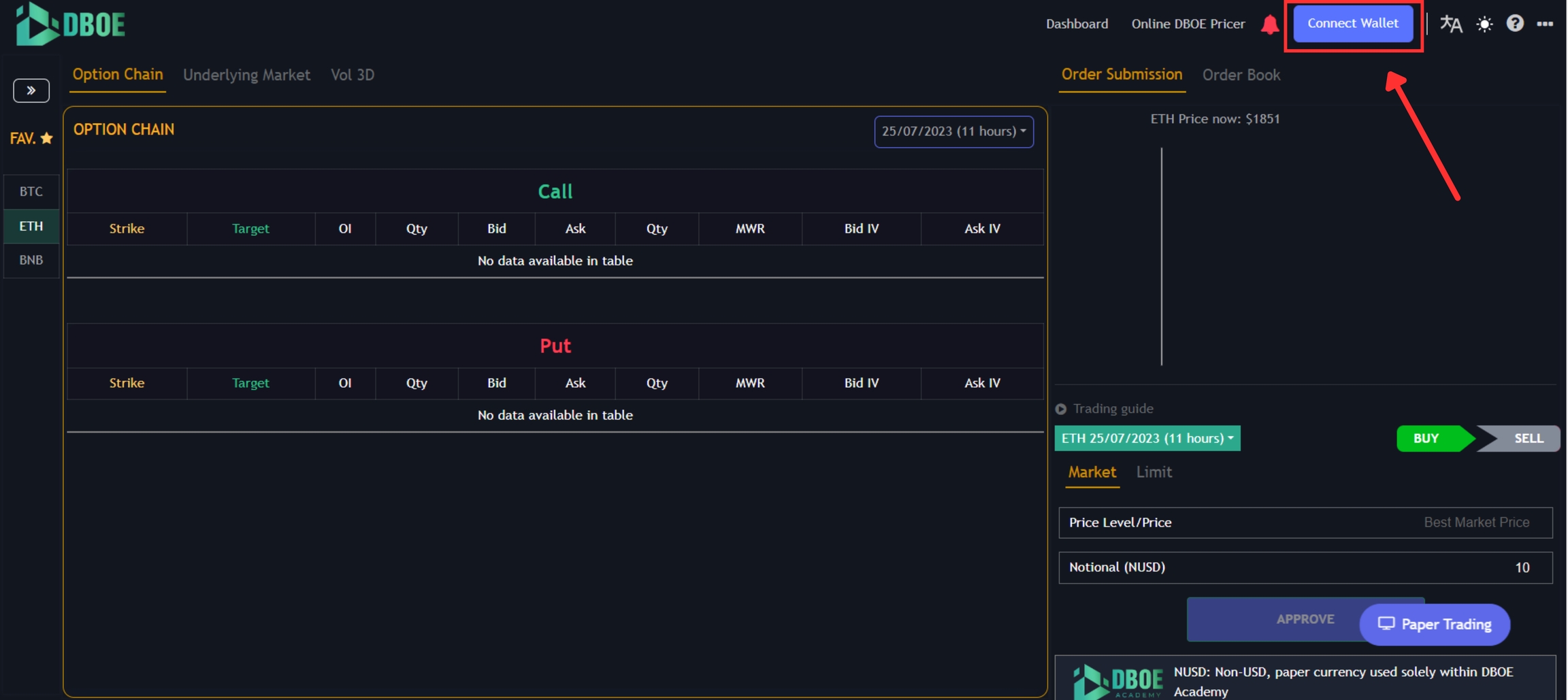

Step 1: Access dboe.exchange and connect your DeFi wallet.

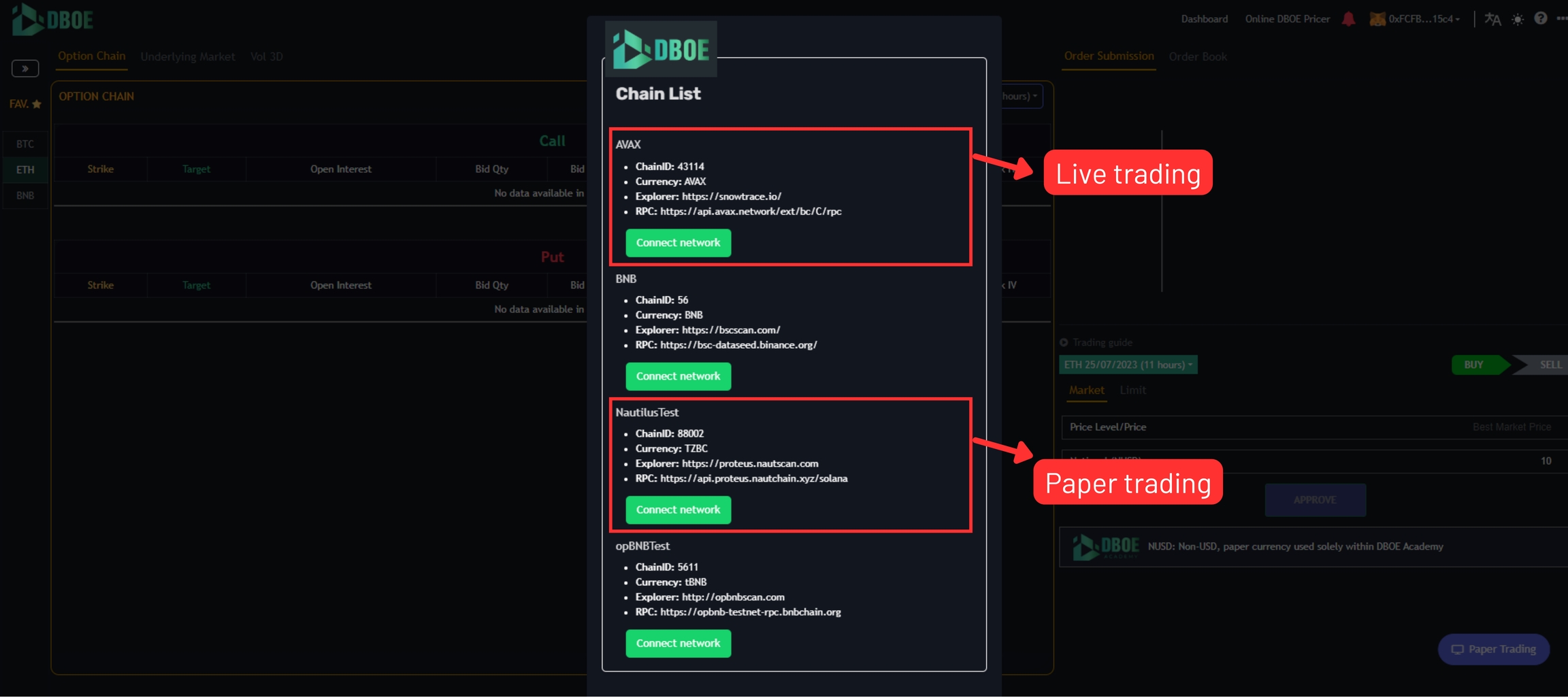

Once your wallet is connected, you can select a network from the Chain List to trade on DBOE. During the go-live event, we recommend choosing AVAX for live trading and Nautilus Test for paper trading.

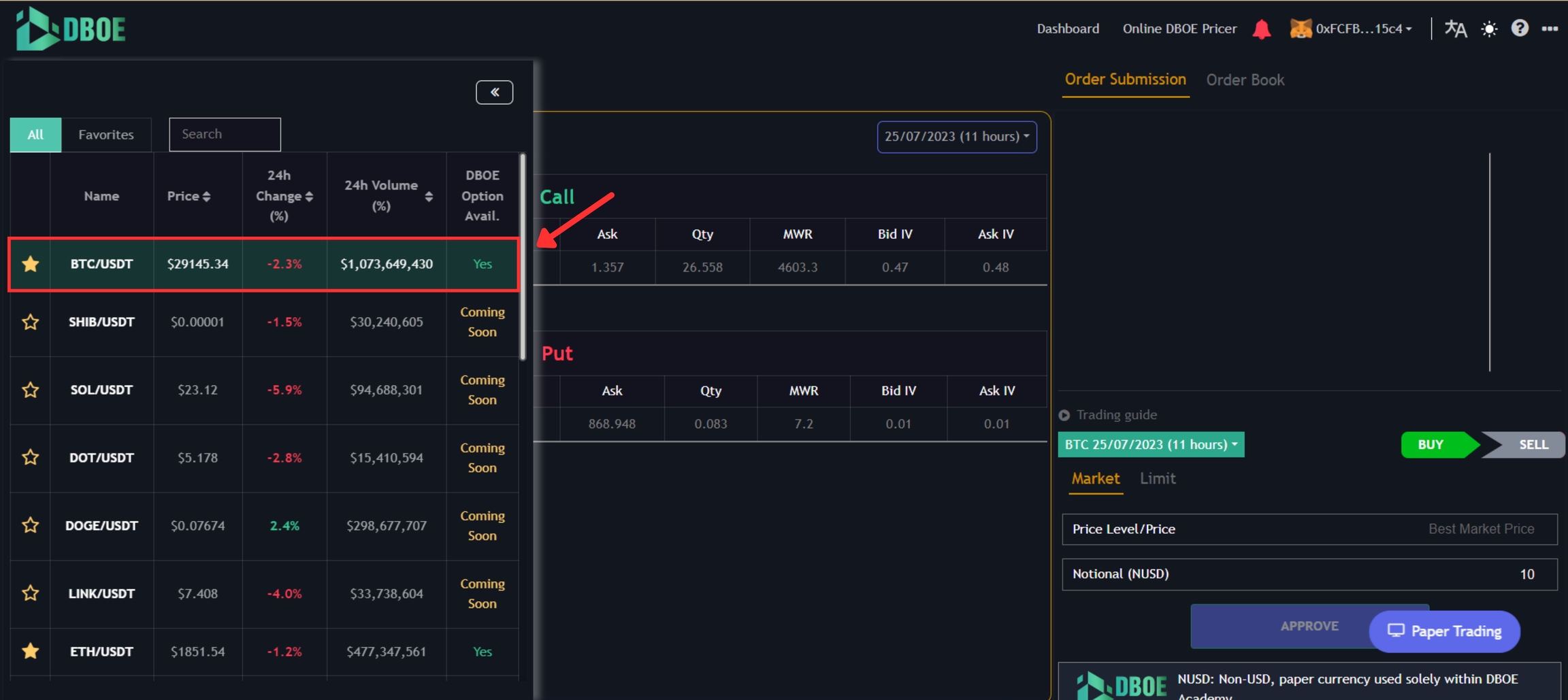

Step 2: Select the token you want to trade (currently supporting BTC).

Step 3: Select the options expiration date and options spread in the Option Chain.

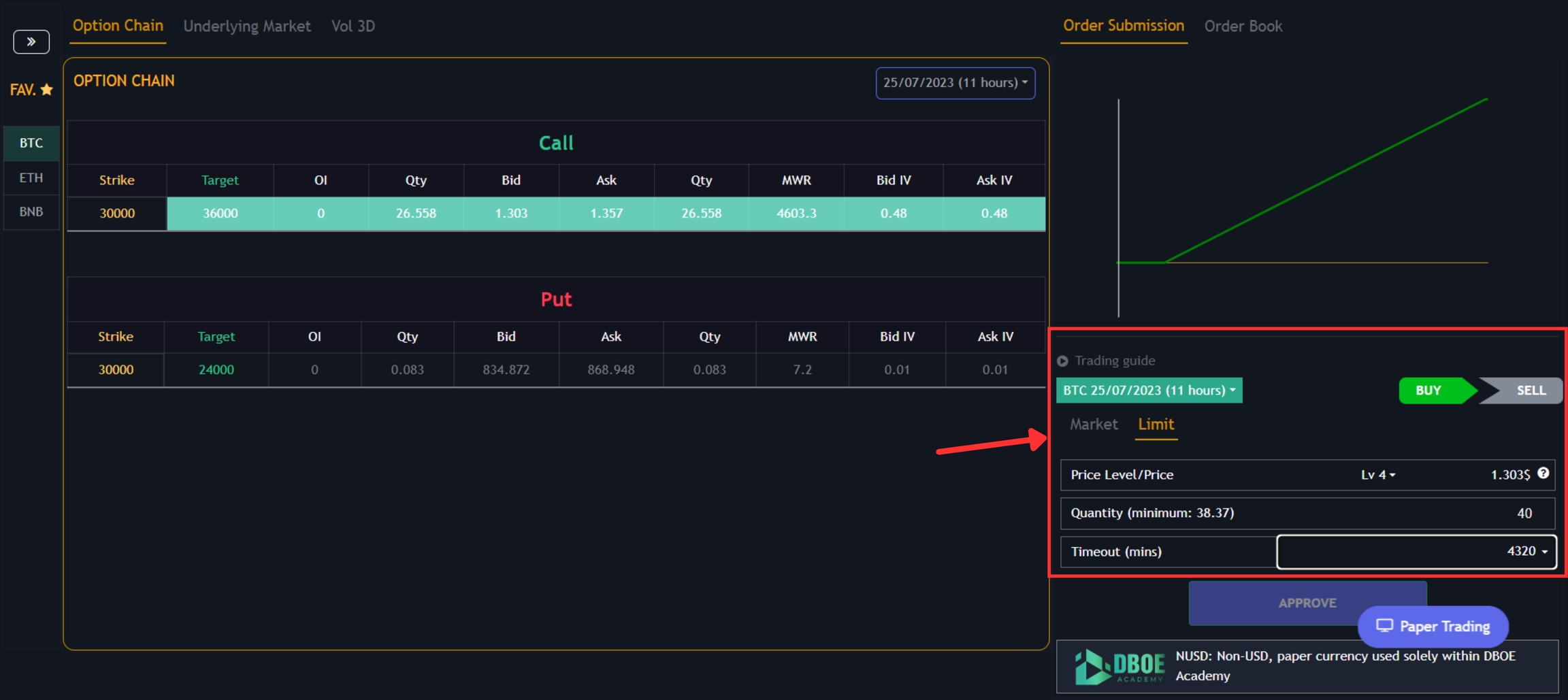

Step 4: Place your order in the Order Submission.

In the Order Submission, you can choose Market order (MKT) or Limit order (LMT).

To place a limit order, select the price level (from level 1 to level 6) and specify the timeout (in minutes). For a market order, it will trigger an immediate matching if there are LMT orders available on the other side.

In the Order Submission, you can choose Market order (MKT) or Limit order (LMT).

To place a limit order, select the price level (from level 1 to level 6) and specify the timeout (in minutes). For a market order, it will trigger an immediate matching if there are LMT orders available on the other side.

When placing a limit order, your successful order will be recorded in the “Open Orders” tab. For a market order, it will be recorded in the “Positions” tab after it is executed successfully.

⚠️ Important Note:

Please note that the minimum trade for limit orders is 0.5 USDT.

In case you intend to open a short position (sell call or sell put options), ensure that you have enough balance for collateral and meet the necessary requirements.

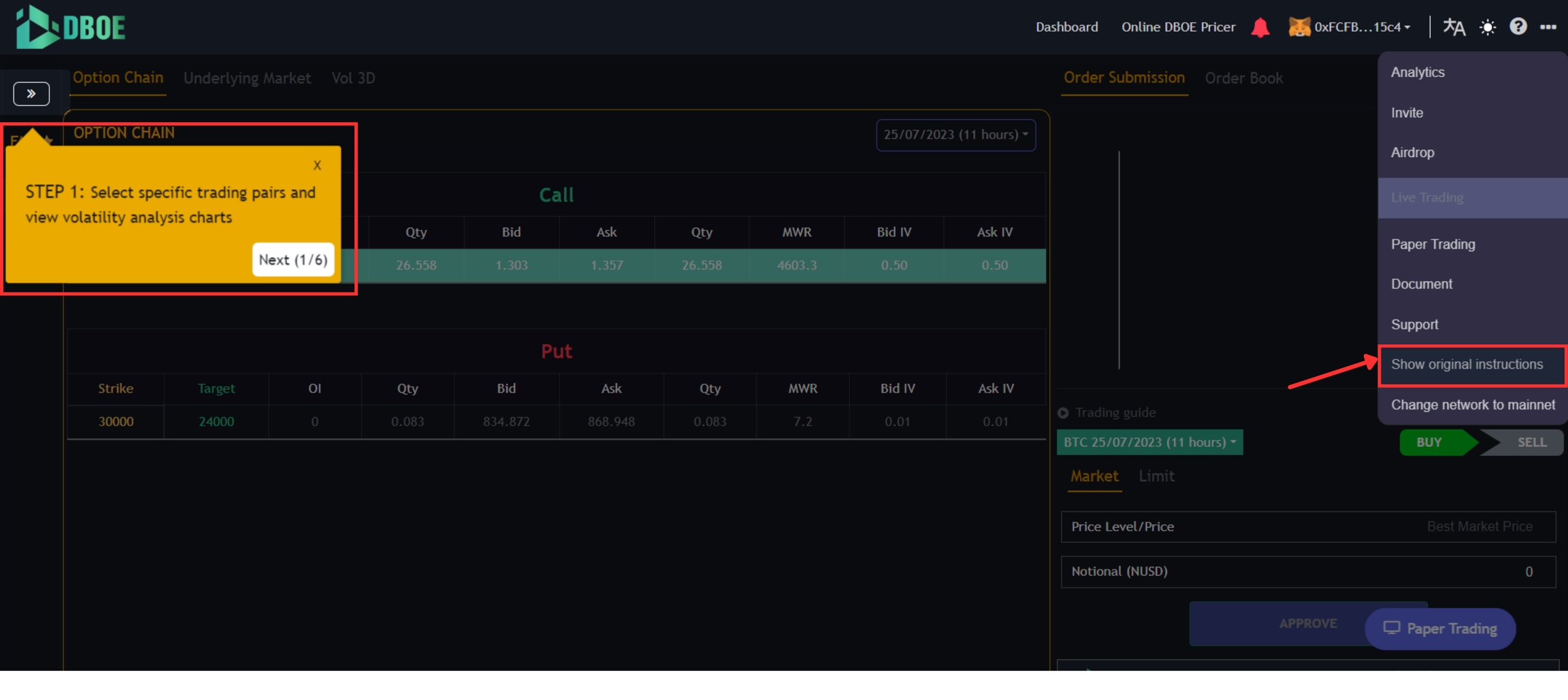

For concise instructions, click on the three horizontal dashes symbol located in the top right corner of the screen, and then select “Show original instructions”.

GO-LIVE FAQS: EXPLORING DBOE TRADING FEATURES

Question 1: What are order types currently supported by DBOE?

DBOE is supporting two order types: LMT (Limit) order and MKT (Market) order.

Question 2: What are the current fixed spreads?

See the answer here.

Question 3: How are transaction fees calculated?

See the answer here.

Question 4: Is there a fee refund for unmatched orders? Can pending orders be cancelled?

Users are allowed to cancel their orders before the timeout; however, there will be no gas fee refund. The gas fee is the amount paid for the network to process a transaction, regardless of the order type selected. Therefore, users will not receive a fee refund upon cancelling an order.

Question 5: Can open orders (LMT orders) remain until matched?

The duration of each LMT order depends on the timeout you select.

For example, if you set a timeout of 1 minute, your LMT order will be active for only 1 minute and will automatically expire if no matching order is found within the allotted time.

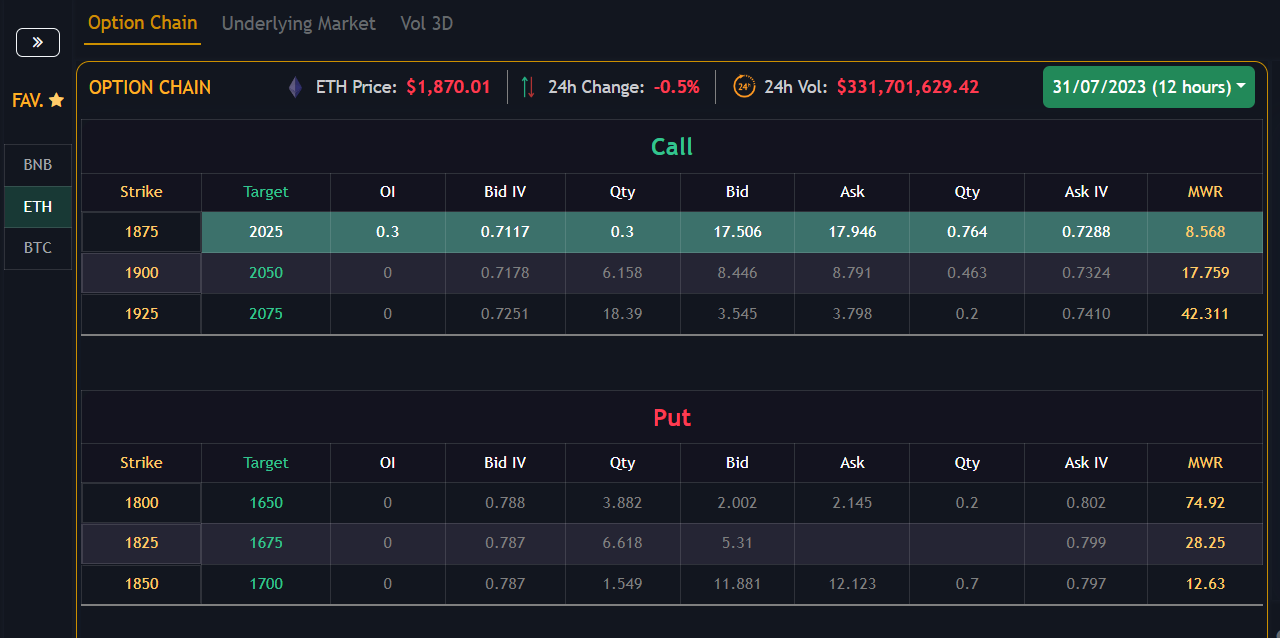

Question 6: What is MWR and how to calculate them?

MWR stands for Max Winning Ratio, representing the maximum profit attainable with purchased Options.

Example of MWR: Let’s say you buy a ETH call option at a strike price of $1,875 and a target price of $2,025. The option contract will expire in the next 12 hours.

Bid price (options premium): $17.506

Options Spread: $2,025 — $1,875 = $150

MWR (Max Winning Ratio): $150 / $17.506 = 8.568

Question 7: Is it possible to choose price ranges outside of the existing options in the option chain?

If you want to trade using different price ranges beyond the six existing price levels, kindly reach out to the DBOE team via email at inbox@dboe.io.

Question 8: Paper Trading and Live Trading — What’s the difference? Can users practise with paper trading before venturing into live trading?

Live trading allows users to engage in trading with their real money, which is available starting from the go-live date on July 28, 2023.

In DBOE Academy’s paper trading, NUSD serves as paper currency, enabling users to practise trading options without any cost for educational purposes.

To access paper trading, users can click on the floating Paper trading icon located in the right corner of the trading platform. By providing their email and wallet address, they can then click “Gimme ZBC & NUSD” to receive free tokens for paper trading.

Question 9: When can I exercise my options? What happens after I exercise them?

Users can exercise options after they have expired. To do so, simply visit dboe.exchange after the options expiration time and go to the “Positions” tab. Look for the green light button labelled “Final settle (post expiry)” and click on it. Afterward, check your balance on your Metamask account.

Remember to assess whether your options are at the money, in the money, or out of the money to make informed decisions during the exercise process.

Question 10: Other questions

For any additional queries, join our Discord and Telegram Group for prompt support.

Last updated