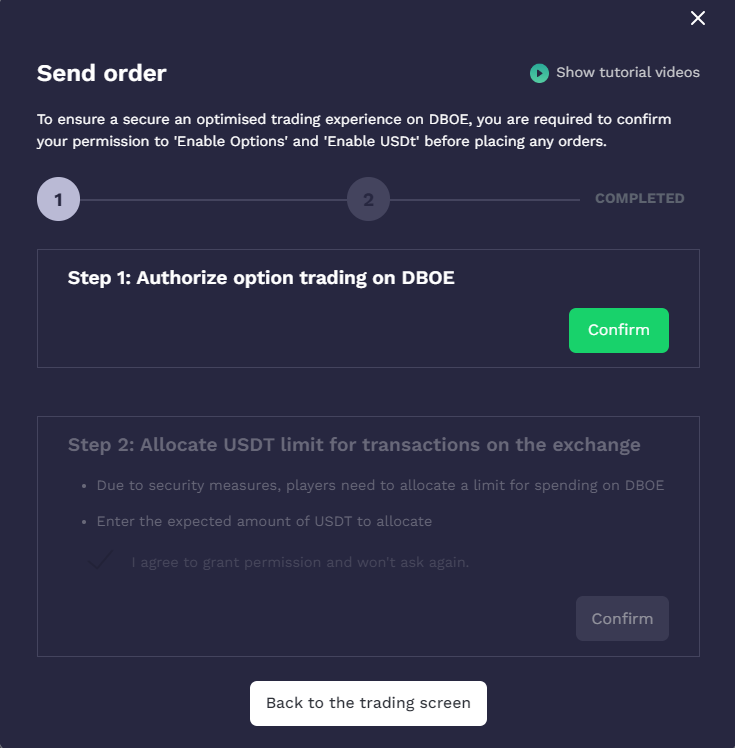

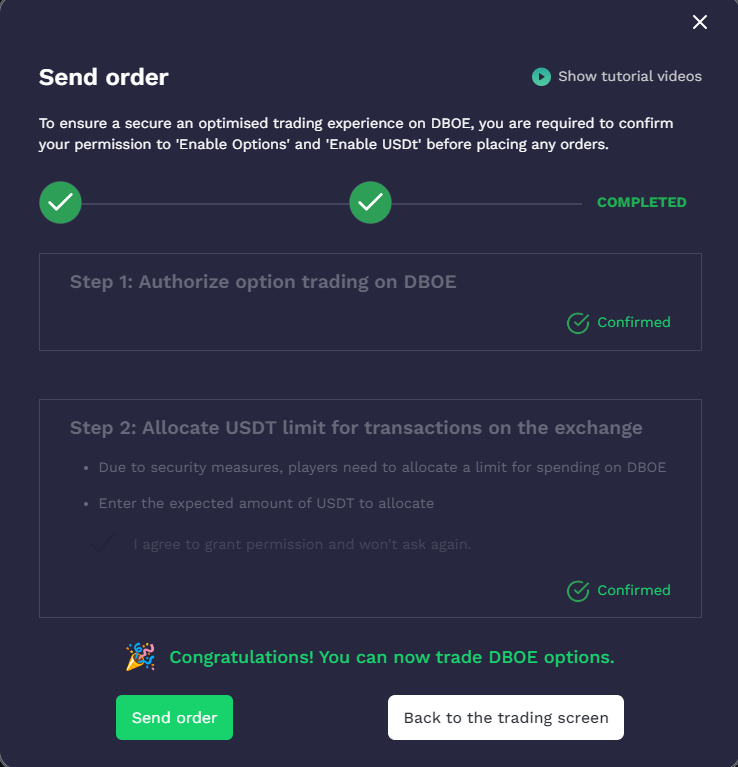

11. What are the order submission steps and the Min. Allowance in DBOE?

The order submission process involves three steps: "Enable Options," "Enable USDt," and "Send Order." These steps ensure that users have sufficient balance and allowance for options trading.

Step 1: Checking Previous Option Position

This step is activated when users have an option position in the opposite direction, for instance, if a user wants to buy (Long) but has a Short position.

Step 2: Checking currency

For options sellers, the min.allowance in this step refers to the collateral required.

Suppose a user wants to place a limit order (LMT) to Sell Call ETH Option with a strike price of $1.875 and a target price of $2,025, with the option contract expiring in the next 11 hours.

If the option price level 1 is $12.603, and the user enters a quantity of 1 option at the price of $12.603, then the Min. Allowance will be calculated as follows:

Min. Allowance = [Amount * (Target price - Strike price) - Premium] * 125% = [1* ($2,025 - $1,875) - $14,593] * 125% = $169.31

If your wallet balance is less than $169.31, you cannot proceed to step 3. Please consider reducing the amount of options you intend to sell.

The additional 25% (in the 125% calculation) is allocated for limit (LMT) orders because they might take longer to be processed. This precaution helps avoid situations where the order stays in the queue without sufficient allowance for matching.

Step 3: Send Order

Once DBOE successfully checks your account, you can proceed to send your order.

These steps help ensure users have the required balance and allowance for a successful options trading experience on DBOE.

Last updated